Welcome Meb Faber Podcast Listeners. Sign up for an account at PeerStreet and receive a 1% Yield Bump on your initial investment. Must qualify as an accredited investor. Read the full program rules here.

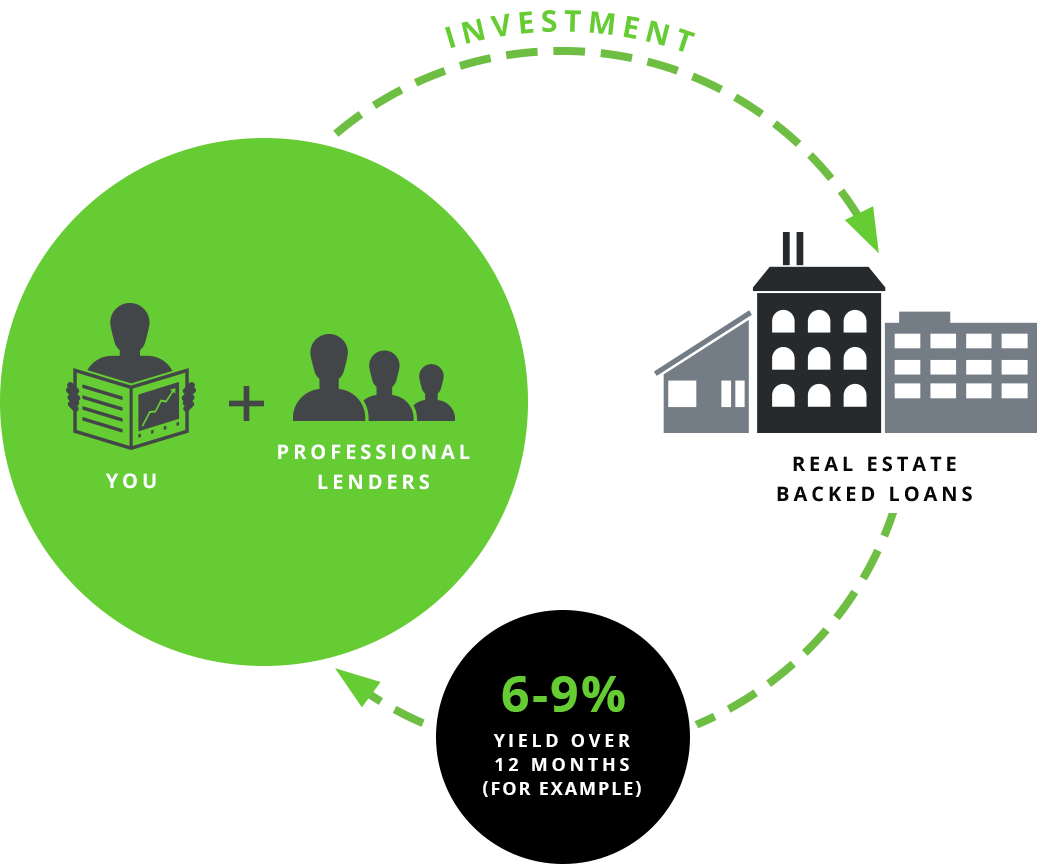

Get StartedPeerStreet’s investments have similar yields to LendingClub, but are backed by real estate and carry very attractive loan-to-value ratios. Simply a smarter way to invest.Dr. Michael Burry Founder and CEO, Scion Asset Management, LLC

Featured in Michael Lewis’s “The Big Short”

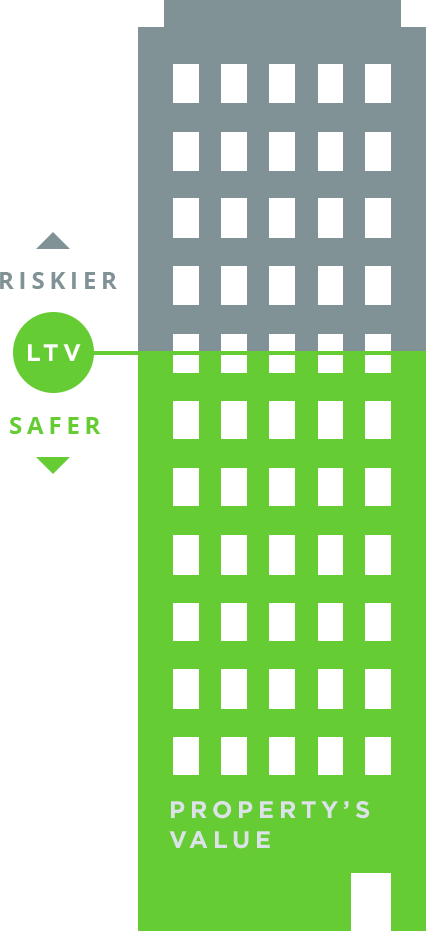

Debt is the safest type of real estate investment. It's senior to the borrower's equity, providing a cushion that protects the lender's investment.

Historical loan terms

Returns:

6-9% Annualized

LTV:

75% & Under

Duration:

6 to 36 Months

The above historical terms do not include all investment opportunities on the PeerStreet platform

New products have been added with differing rates, LTVs and durations.

Sign Up To Learn MoreThe PeerStreet team's extensive expertise in real estate and big data analytics gives us an edge in providing an innovative way for investors to access real estate loans.

See How It WorksJoin PeerStreet and get access to high quality real estate backed loans.

Get Started